when are draftkings tax forms available

Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. Requests for withdrawal of funds will be processed within fourteen 14 business days of receipt by DraftKings of any tax reporting paperwork required by law and any other documentation that may be required by these Terms such as a copy of your drivers license or credit card unless DraftKings believes in good faith that you engaged in either fraudulent.

Draftkings Sportsbook And Casino Pa How To Play And Get 1 500 Free

Also Know how long does it take DraftKings to give you your winnings.

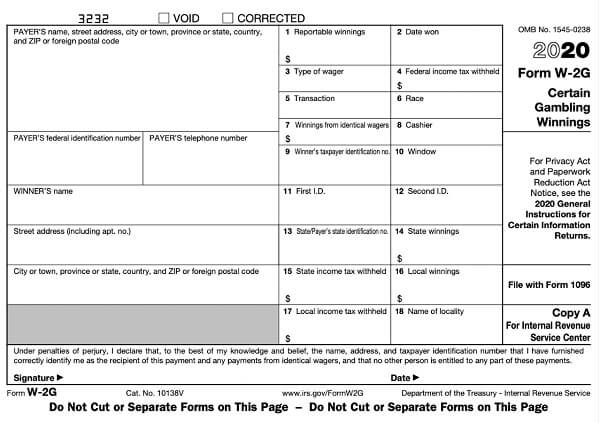

. Ive read they usually ask for an extension but I have not seen any updates. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. How do I opt in to electronic-only delivery of tax forms 1099 W-2G from DraftKings.

Players who believe that funds held by or their accounts with DraftKings Inc. If you receive your winnings through PayPal the reporting form may be a 1099-K. For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you.

Please advise as to where I input this other income that is not considered gambling however it was gambling winnings. Draftkings has this written regarding taxes. If you have winnings of over 600 from any Daily Fantasy Sports site such as FanDuel or DraftKings you will likely receive a Form 1099-MISC with the amount shown on Box 3.

Why am I being asked to fill out an IRS Form W-9 for DraftKings. DRAFT KINGS -- weird thing - just wonderin. DraftKings seems to think that since they have the option to file for an extension they should do that most years because they cant do things in a timely fashion.

How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. Waiting on them and Robin hood for documents.

Why am I being asked to fill out an IRS Form W-9 for DraftKings. We should mention that most bettors should have received their DraftKings 1099 forms in the mail after February 1st. Where to put 1099 MISC form from DraftKings.

You can expect to receive your tax forms no later than February 28. Learn more about the IRSs taxable reporting criteria for gambling winnings and IRS Form W. Tax Return Access.

DraftKings at Casino Queen shall use commercially reasonable efforts to process requests for withdrawal within fourteen 14 days of DraftKings at Casino Queens receipt from the user of any tax reporting paperwork or other information reasonably required by DraftKings at. In order to update your recipient information please use the instructions for changing your personal information. Has anyone heard any updates on draftkings releasing the 1099 forms this year.

Form W-2G reports gambling earnings and tax withholdings. You can claim a refund of the tax FanDuel and DraftKings representatives said they mail tax forms. DraftKings is required to issue 1099 tax forms to any player who has a cumulative net profit in excess of 600 for the calendar year.

You do have to pay taxes on your Cumulative Net Profit from fantasy sports. According to Draft Kings the accounting department processes withdrawals each Monday through Friday at 9. The information provided on this page doesnt constitute tax advice and DraftKings advises its customers to consult with a professional when preparing their taxes.

Daily Fantasy Tax Reporting. You consent to receive your DraftKings related tax information electronically which information will be securely hosted by DraftKings and accessible by you through your player account page for at least seven 7 calendar years following the year to which the information relates. Terms and conditions may vary and are subject to change without notice.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. 6 rows Key tax dates for DraftKings - 2021. The deduction is only available if you itemize your deductions.

This article covers how you get your DraftKings sportsbook tax form in addition to how you fill in your DraftKings tax form. Anyone know when they are usually available in the tax document area on the site. And yes even your friend managing a league would need to send out tax forms if the winner earned 600.

How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. Forms 1099-MISC and Forms W-2G will become available.

Have been misallocated compromised or otherwise mishandled may register a complaint with DraftKings Inc. How do I opt in to electronic-only delivery of tax forms 1099 W-2G from DraftKings. Gambling losses are indeed tax deductible but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return.

August 13 2021 0844. A majority of companies issue tax forms by January 31st every year as required by law. That goes not just to.

This is calculated by the approximate value as prizes won - entry feesbonuses. SPORTS Live Sports Betting Odds. I received a 1099-MISC form from DRAFTKINGS- an online sports gambling.

1099s are usually sent by the end of January but many still wait for their DraftKings 1099 forms which support has been saying will arrive in 2-4 weeks.

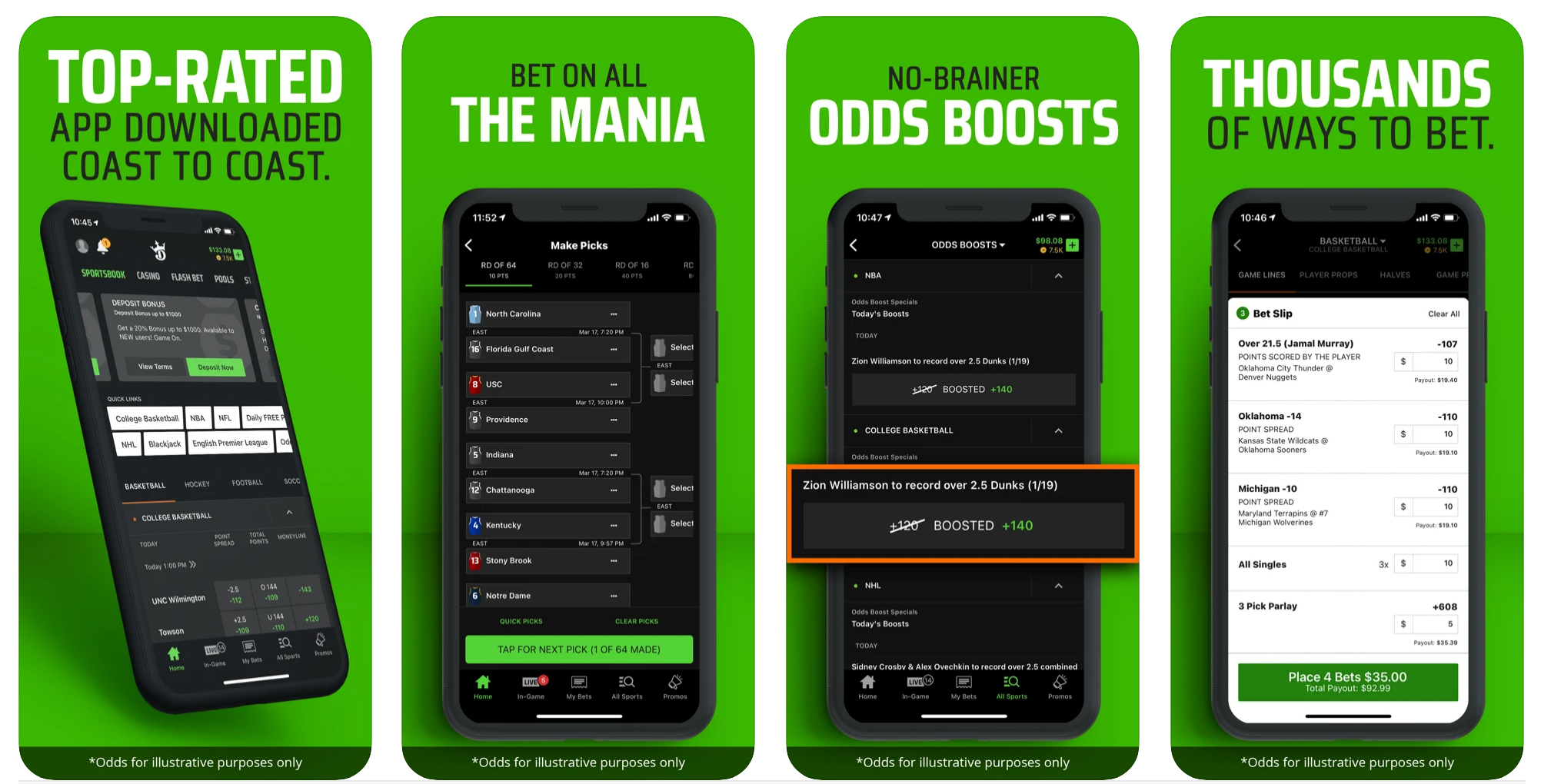

Draftkings Sportsbook Is Offering No Juice Nfl Spreads Crossing Broad

Draftkings Tax Form 1099 Where To Find It How To Fill

Tennessee Sports Betting Goes Live As Taxes Hold Requirments Favor Betmgm Draftkings Fanduel

Draftkings Tax Form 1099 Where To Find It How To Fill

Restore Restricted Or Locked Draftkings Sportsbook Account

Terms Of Use Draftkings Sportsbook

Draftkings Sportsbook Florida 2022 Promotions And Preview

Draftkings Sportsbook Review Vegasinsider

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/69721003/DK_Nation_1800x1200_6.0.png)

Nft Explained What Are Nfts And How Do They Work In The Draftkings Marketplace Draftkings Nation

Draftkings Sportsbook Review Vegasinsider

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Draftkings Fanduel Legal States Where Is Dfs Allowed

Fanduel Vs Draftkings Sportsbook Which Sports Betting App Is Better Crossing Broad

Draftkings Canada Ontario Sportsbook Sign Up Offer Launch Details

Draftkings Begins New Era With Official Launch Of Sportsbook In New Jersey Business Wire

Draftkings Begins New Era With Official Launch Of Sportsbook In New Jersey Business Wire